Monetary Policy Analysis

A Decade of Policy Challenges

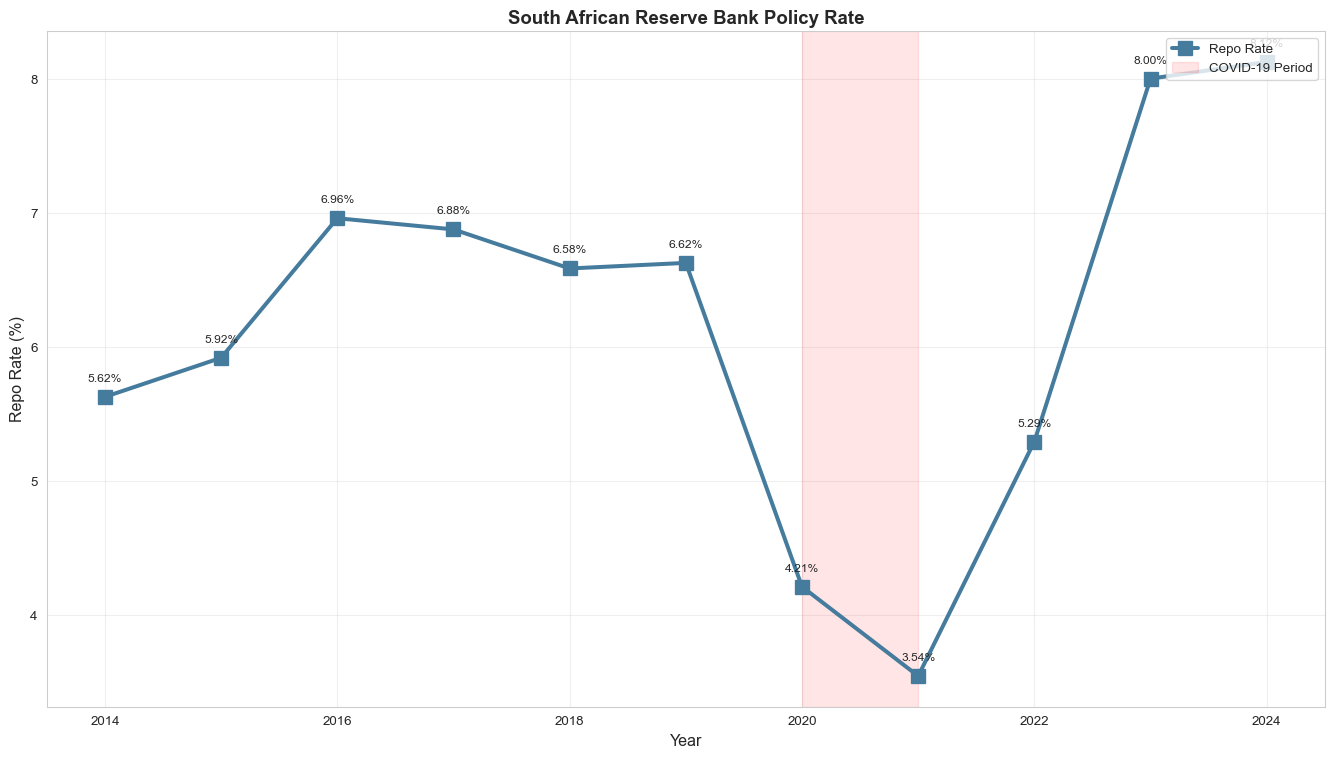

The South African Reserve Bank has navigated extraordinary challenges over the past decade, employing its repo rate as the primary tool to maintain price stability whilst supporting economic growth and financial stability. The period has been marked by three distinct phases: post-crisis normalisation (2014-2019), pandemic response (2020-2021), and inflation containment (2022-2024).

Key Statistics: Over the decade, inflation averaged 5.1%, whilst the repo rate averaged 6.2%, reflecting the SARB generally hawkish stance to maintain credibility.

Phase 1: Post-Crisis Normalisation (2014-2019)

During this period, the SARB faced the challenge of supporting a sluggish economy whilst managing inflation expectations. Key developments included:

- 2014-2015: Rate movements from 5.62% to 5.92% as inflation pressures emerged

- 2016: Policy rate at 6.96% as inflation pressures persisted

- 2017-2019: Policy adjustments with rates at 6.62% by end-2019

- Structural challenges: Load-shedding, policy uncertainty, and weak growth constrained monetary policy effectiveness

The SARB maintained a careful balance, prioritising inflation targeting credibility whilst acknowledging growth headwinds.

Phase 2: COVID-19 Response (2020-2021)

The pandemic prompted unprecedented monetary accommodation:

- Aggressive easing: Substantial rate cuts in 2020, bringing the repo rate to 4.21%

- 2021 stance: Rates at 3.54% to support recovery

- Inflation subdued: Weak demand and oil price collapse kept inflation near the bottom of the target band

- Financial stability measures: Regulatory forbearance and liquidity provision supplemented rate cuts

This period demonstrated the SARB flexibility within its inflation-targeting framework, prioritising economic support when inflation risks were clearly to the downside.

Phase 3: Inflation Containment (2022-2024)

Global inflation shocks required decisive policy response:

- Policy tightening: Rates increased to 5.29% in 2022 and 8.00% in 2023

- Current stance: Repo rate at 8.12% in 2024

- External pressures: Russia-Ukraine conflict, supply chain disruptions, and food/energy price spikes

- Domestic factors: Rand weakness, load-shedding costs, and administered price increases

- Front-loaded approach: SARB acted early and aggressively to prevent de-anchoring of expectations

Implications for Households

The SARB policy stance has profound household impacts:

Cost of Living: - Higher interest rates increase debt servicing costs substantially - Mortgage payments have increased significantly in recent years - Credit card and personal loan costs have surged, constraining disposable income

Savings and Investment: - Improved returns for savers as rates have risen - Pension fund returns affected by bond market volatility - Real returns remain challenged when inflation exceeds deposit rates

Consumption Patterns: - Reduced purchasing power during high inflation periods - Shift towards essential spending as discretionary income declines - Increased financial stress for highly indebted households

Growth Implications

Monetary policy has significant growth trade-offs:

Short-term Costs: - Higher rates constrain credit growth and investment - GDP growth constrained during tightening cycles - Business confidence undermined by policy uncertainty

Long-term Benefits: - Price stability supports investment planning - Anchored inflation expectations reduce risk premiums - Currency stability enhances trade competitiveness

Structural Constraints: - Monetary policy cannot address electricity supply, infrastructure decay, or skills shortages - Limited policy space given high government debt and external vulnerabilities - Need for structural reforms to raise potential growth

Financial Stability Considerations

The SARB has balanced price and financial stability objectives:

Banking Sector: - Higher rates improve net interest margins but increase credit risks - Non-performing loans rising as households and businesses struggle - Capital buffers remain adequate but require monitoring

Asset Markets: - Property market cooled by higher mortgage rates - Equity valuations compressed by higher discount rates - Bond market volatility reflecting global and domestic risks

External Vulnerabilities: - Current account deficit financing dependent on portfolio flows - Rand volatility amplified by global risk sentiment shifts - Foreign exchange reserves adequate but not excessive

Policy Outlook and Conclusions

Looking Ahead

The SARB faces continued challenges in the period ahead:

Near-term Priorities: - Ensuring inflation returns sustainably to target midpoint - Managing expectations as global central banks potentially ease - Balancing growth support with price stability mandate

Medium-term Considerations: - Potential for gradual easing once inflation firmly anchored - Need to rebuild policy space for future shocks - Coordination with fiscal policy to address structural constraints

Long-term Framework: - Debate over appropriate inflation target level and band width - Consideration of financial stability in monetary policy framework - Climate change implications for monetary policy transmission

Key Takeaways

1. Credibility Maintained: Despite severe shocks, the SARB has kept inflation expectations relatively anchored through decisive action

2. Flexibility Demonstrated: The COVID response showed pragmatism within the inflation-targeting framework

3. Trade-offs Acknowledged: Growth sacrificed in the short term to preserve long-term stability

4. Structural Limits: Monetary policy alone cannot address South African growth challenges

5. Forward Guidance: Clear communication has enhanced policy effectiveness and market understanding

The past decade illustrates both the power and limitations of monetary policy. Whilst the SARB has successfully navigated multiple crises and maintained price stability, sustainable economic progress requires complementary fiscal, structural, and institutional reforms. The repo rate remains a blunt instrument that cannot substitute for the broader policy reforms needed to unlock South African economic potential.

For households, the message is clear: periods of higher interest rates, whilst painful, are necessary to preserve the purchasing power of income and savings. The alternative - allowing inflation to become entrenched - would impose even greater long-term costs on society, particularly the poor who lack inflation hedges. As South Africa continues its economic journey, the SARB commitment to price stability provides an essential anchor in turbulent times.