European bank-sovereign doom loop

September 30, 2017

European banks and sovereigns are much more closely linked than American banks and their government. The resulting bank-sovereign doom loop has been gathering strength, since the 2008 crisis.

I was asked to discuss "disentangling sovereign and bank risk" at the European Supervisor Education Initiative conference in September 2017, and I summarise my contribution below.

Banks and sovereigns are joined at the hip, so to speak, and there is not much we can do about that. When things go pear-shaped, a banking crisis may well end up causing a sovereign debt crisis or vice versa.

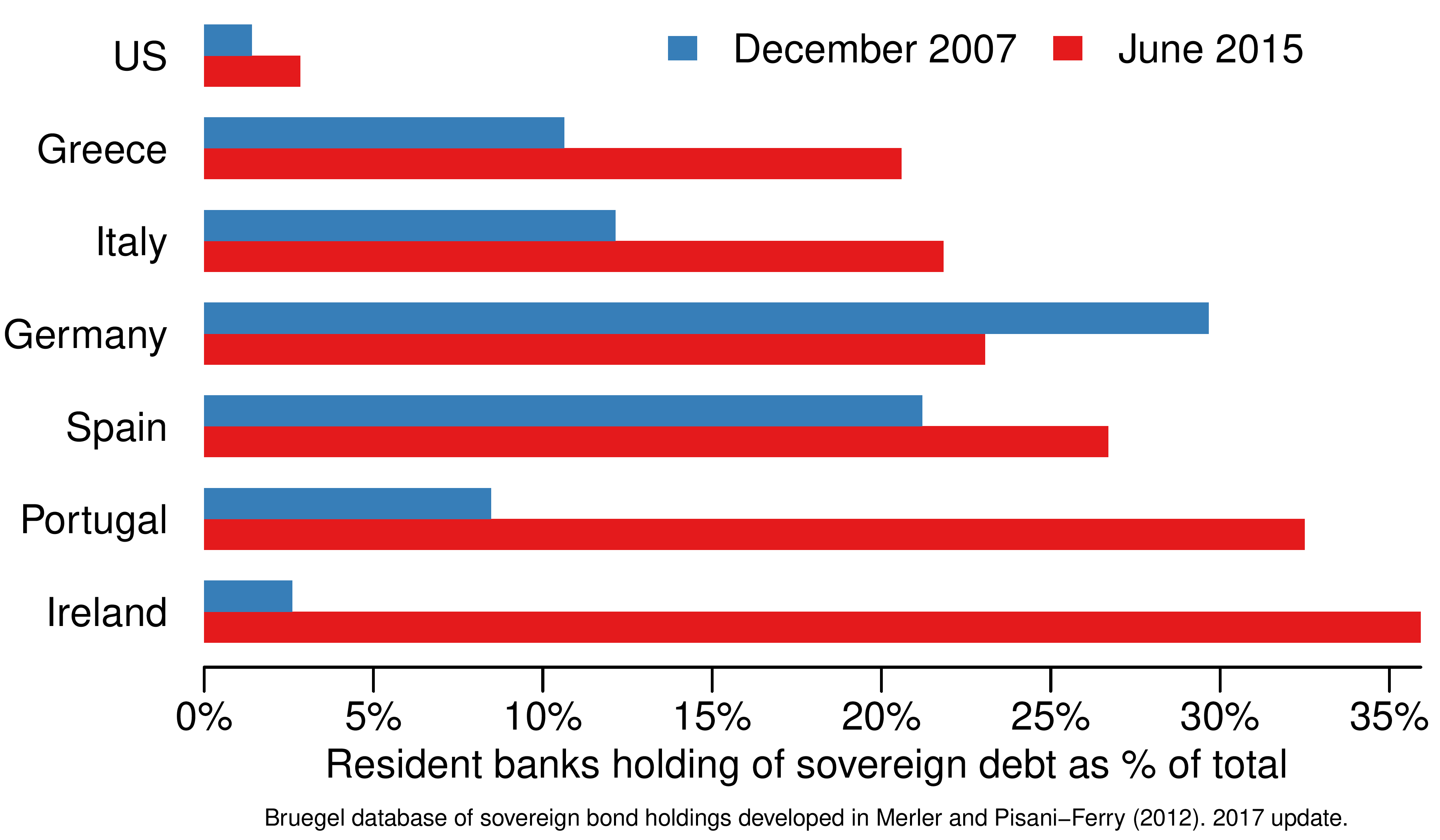

Still, different countries find a way to quite effectively mitigate the problem and others not. The most obvious link is between bank holdings of their own sovereign debt and there are interesting differences across countries, as seen in the following figure, using data from the Bruegel sovereign bond holding database:

American banks hold less than 3% of their own government debt, a number that has only slightly gone up since the crisis. For German banks it is over a fifth. It is however the crisis countries that very significantly have increased their exposure to their own sovereign.

The root cause is the inherent conflict between the objectives of the relevant four policy domains, fiscal policy, monetary policy, macro and micro prudential. Add to that issues arising from immediate crisis resolution compared to long-run stability objectives.

Fiscal policy wants to keep the borrowing costs of the sovereign down. Banks own a lot of sovereign dept and if that debt is risk-free — for the purpose of capital calculations — then the borrowing costs of the sovereigns fall. Not surprisingly, we have a European directive doing exactly that.

Monetary policy wants to do quantitative easing, inevitably executed via the banking system and until recently needing European banks to buy their own sovereign bonds.

The end result:

- It taxes SME loans to subsidise government loans — financial repression causing lower economic growth;

- It makes banks solvency more dependent on the solvency of the sovereign.

Ultimately, the objectives of fiscal policy and monetary policy have strengthened the banks- sovereign doom loop.

While there is no easy way for dealing with the bank-government doom loop, it can be mitigated by reducing banks' holdings of their own government debt. Banks of course need to hold some safe assets, but there is no reason why Italian banks should not hold their safe assets in the form of German government bonds, except of course the Italian government needs someone to buy its own bonds.

Can the problem be solved by one of the the various schemes being promoted, perhaps Eurobonds or some CDO type structuring of European sovereign debt?

Not really.

Leaving aside the obvious political problems, someone still has to own the bonds, and that is still going to be the banks, pension funds and insurance companies, not to mention the ECB itself.

If we create a CDO type structure, will any of the large buyers of bonds want to own the lower tranches? To experience losses if one of Greece, Italy, Portugal, Spain or France defaults? Would the micro prudential regulators be happy about that?

Even if we can find buyers, we still need to find a way to reform nonperforming economies. Otherwise, we just end up creating a future sovereign debt crisis, this one with much more serious consequences for European integration and more serious systemic consequences than the one we had over the past few years.

But then, we will not need these products in the first place. So why bother?

Models and risk

Bloggs and appendices on artificial intelligence, financial crises, systemic risk, financial risk, models, regulations, financial policy, cryptocurrencies and related topics© All rights reserved, Jon Danielsson,