On the Swiss FX shock

Risk Models Policy

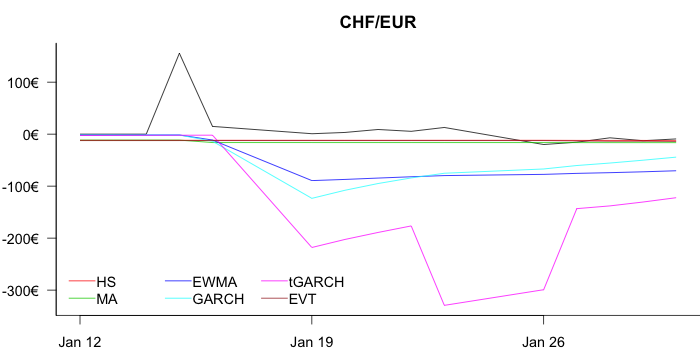

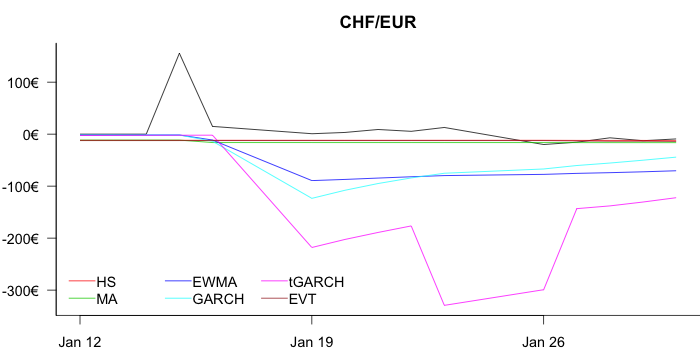

The original analysis in Swiss FX shock just looked at the risk of the Franc appreciating, but why not look at the risk of the euro appreciating. Starting with the Franc to Euro

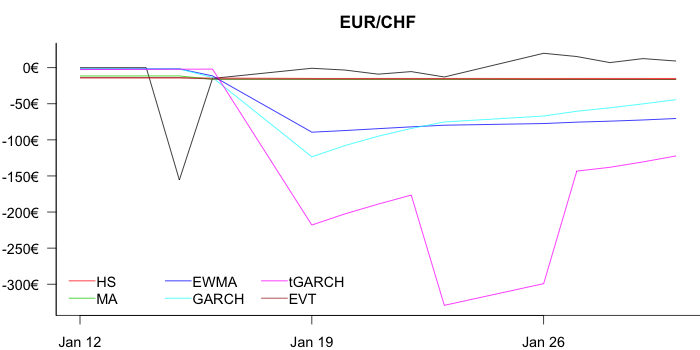

and the inverse

It shows just how badly the t-GARCH performs, no surprise, it certainly needs more than 1000 days used here for the estimation. HS and EVT hardly budge, and GARCH recovers faster than EWMA.

Also, it is interesting that the symmetric methods see the risk the same way, regardless of appreciation or depreciation. That of course falls out of the model structure, but it doesn't make that much economic sense.