IMF and Iceland

Iceland

The interview is here in Icelandic.

My take on the Icelandic economy is here, quite different than that of the Fund. On two specific issues.

Monetary policy

"The Fund is of the opinion that the Central Bank of Iceland ought to be ready to raise interest rates and tighten monetary policy. ... The Fund has a clear idea of what interest rates should be"

For context, inflation is 1.5% and the discount rate 5.75%

This while the rest of world has interest rates of close to zero with inflation not too far from Iceland's. The Fund just got it wrong.

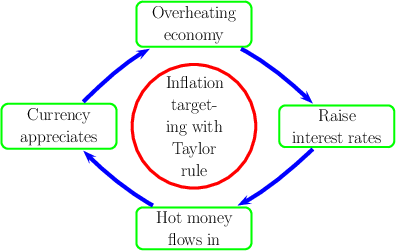

In a smaller country like Iceland, when interest rates are increased, the interest differential attracts carry traders, so hot money flows in, leading to a currency appreciation. This has several impacts:

- The money inflows get intermediated to the domestic economy and therefore increase the money supply, which then stimulates the economy;

- The appreciating exchange rate causes positive wealth affects, further stimulating the economy;

- This then causes the automatic Taylor rule to further increasing interest rates;

- Further increasing inflows.

The resulting vicious feedback loop is why inflation targeting using the Taylor rule, what is behind the Fund's position, is inappropriate for a country like Iceland.

In my analysis of the Fund's conditions, I wrote on VoxEU:

"Immediately following the collapse, the Icelandic central bank was forced to increase interest rates to 18% as a condition of a proposed $2 billion loan from the IMF. The IMF allowed Iceland to reduce its central bank interest rates in March 2009 and they remained in double digits until 2010. As inflation was 7% during that period, while the economy was sharply contracting, it is hard to see what benefit the Fund saw in implementing such orthodox monetary policy."

Bank privatization

Following the resolution of the claims of the foreign creditors of the fallen banks, the government quite recently came to own all the main banks. Obviously, they are to be privatized,

regarding the bank privatization, the view of the Fund is that " the most important is for the government to be patient and find the right buyer... it would be best to find a solid buyer that is foreign with good reputation. The the process should take a few years".

I disagree on the emphasis. When it comes to privatization, the government has two choices:

The government can either maximize the revenue from the privatization or maximize future economic growth. These two objectives are mutually exclusive.

The financial system in Iceland is highly oligopolistic, inevitable giving the small size of the economy. This implies high levels of rent extraction, as evidenced by the very high profitability of the banks. For the economy at large, this is quite costly and holds back on economic growth.

If the government wants to maximize the revenue from the privatization of the banks, it has to do so by enabling them to extract high future rent.

That however will be quite costly for households and firms, who would be much better served by a more diverse and competitive environment.

Because the government is now the effective owner of the banks, it has a unique opportunity to restructure the banking system to increase competition.

In turn that would increase future tax revenues from an economy that grows at higher rates

Maximizing the revenue from the privatization minimizes the future economic benefit from the financial system