What genuinely predicts financial crises?

Risk

Many studies claim to know how to predict financial crises. Most suffer from a small sample problem and even wishful thinking, such as all the papers that have discovered how to predict the crisis in 2008. One observation to forecast, an infinite number of explanatory variables. What could possibly go wrong?

Only two variables predict crises across multiple countries and regimes — credit growth and perceptions of low risk.

Credit growth is the obvious one. We have always known this, and the formal link is documented in the excellent work of the BIS. A country experiencing rapid credit growth will tend to find that all that money eventually ends up in unproductive investments, often real estate. When creditors demand to be repayed and the debtors cannot comply because of all the stupid investments they made, we end up with a crisis. It has happened again and again and again. Credit growth predicts crises.

When Robert Aliber, the author of the excellent book Manias, Panics, and Crashes: A History of Financial Crises, visited Iceland in the summer of 2008, he caused a scandal by predicting a crisis simply by counting all the building cranes he saw on the way from the airport to the TV studio. The Icelandic crisis happened four months later.

What predicts credit growth and, hence, crisis? The perception that risk is low. If investors think the world is safe, then it is perfectly OK to take on more risk, which means credit growths, eventually ending in a crisis.

I document this in a 2018 RFS paper titled Learning from History: Volatility and Financial Crises, co-authored with Marcela Valenzuela and Ilknur Zer.

This is just Minsky — "Stability is destabilising."

What about all the market variables so many are fond of? Market prices, volatility and VIX, CDS spreads, yield curves, etc. etc.? None of these help in predicting crises. They just reflect decisions already made — the market's reponse to the current environment. Once a crisis is underway, the market reacts because uncertainty is already increasing. Risk measures are reactive, not predictive. I looked at this a few years ago in a blog titled VIX and CISS.

The reason is that market risk is a latent variable that cannot be measured, only inferred by how prices have moved in the past. And that requires a model, or what I call a riskometer, device that reacts to the past but doesn't predict the future. Riskometers capture perceived risk, not actual risk.

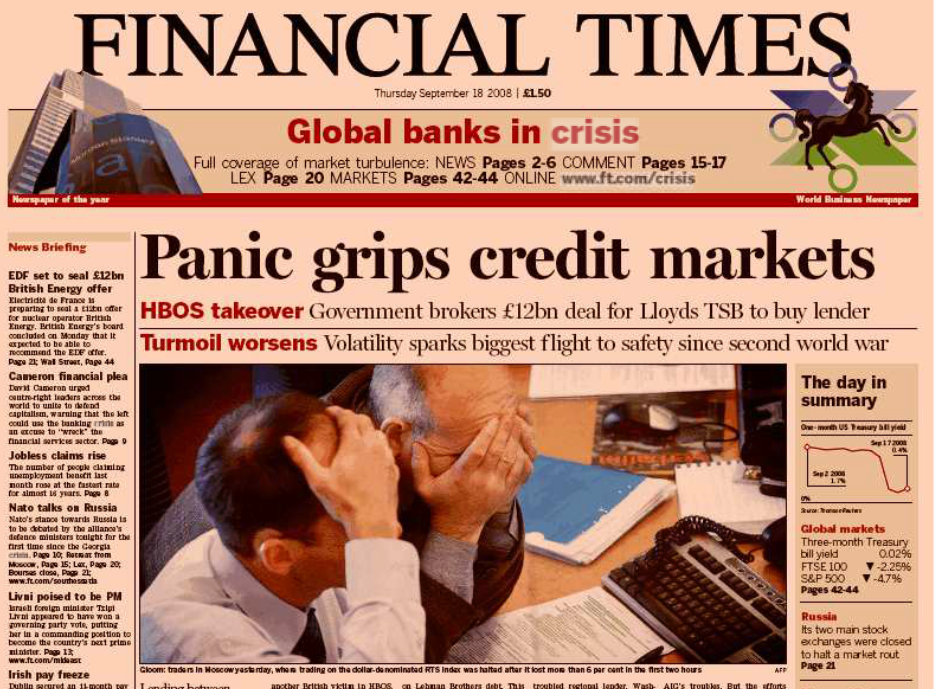

Instead of relying on market risk measures for predicting crises, it might be cheaper to buy a prescription for the Financial Times, whose front page will react at the same time.