Do the new financial regulations favour the largest banks?

Regulations

The reason this happens is because of how the regulations increase the cost of complying.

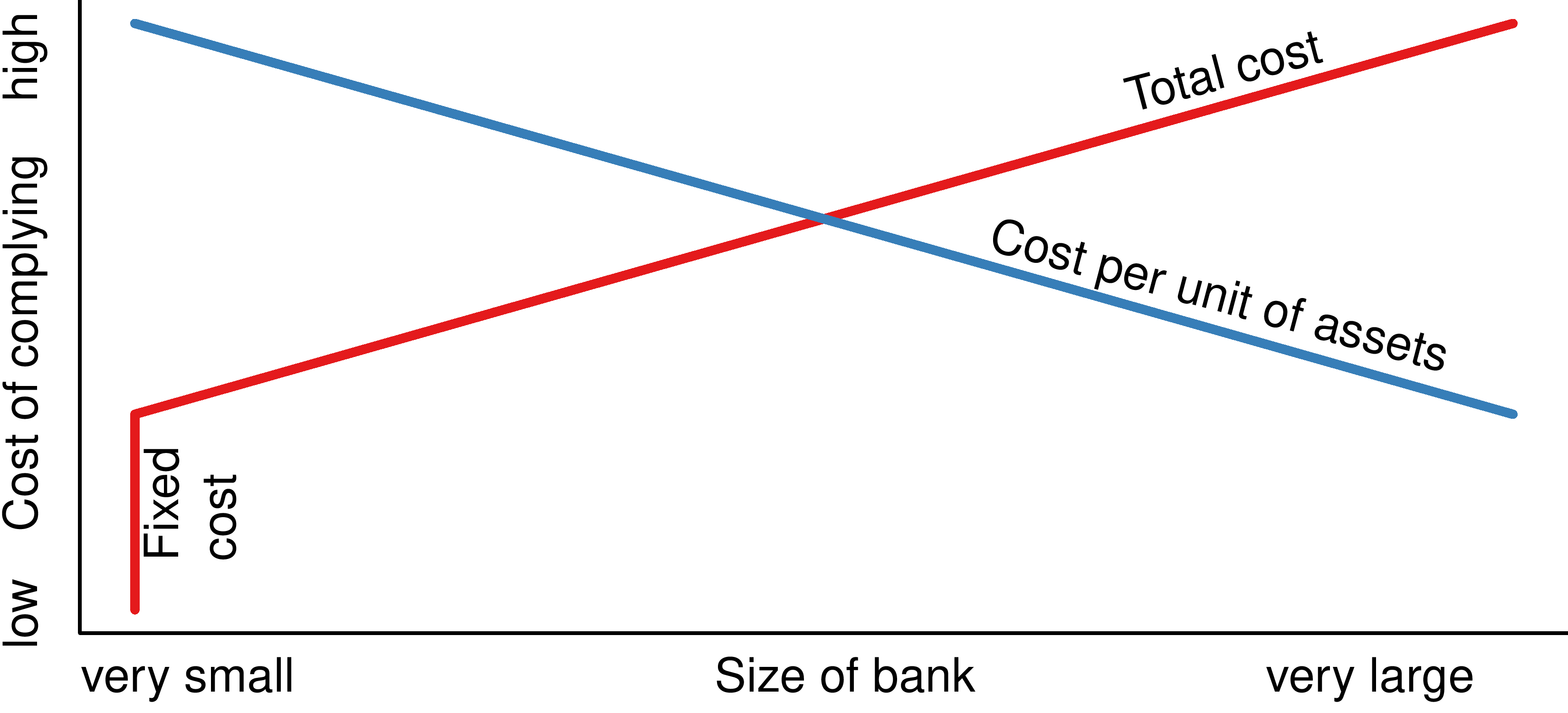

There are two costs a bank has to pay when it comes to complying with regulations. A fixed cost that every bank has to bear, for example understanding how the regulatory apparatus works, knowing the legal environment, and the like. The second cost is variable, the bigger the bank is, the more complex it is and the more it costs to comply.

While well-meaning and generally useful, there is a dark side to this. Because the fixed cost is substantial, the bigger the bank, the cheaper it is, per unit of size, to comply. The trade-off can be seen in the following figure.

In other words, when it comes to complying, there are increasing returns to scale, inherently favouring the largest banks. Because Basel III substantially increases both variable and fixed costs, the largest banks directly benefit, relative to their smaller competitors.

This means that competition is reduced, the cost of financial services will increase holding back growth and the banking system becomes more unstable because the systemically important banks become even more dominant.

The main driver of this is the European authorities because they want to have uniform rules and level playing fields. Yes, proportionality is supposed to correct for this, but doesn't seem to work all that well. The larger banks have much more effective lobbying power, while the smaller banks find it hard to have their concerns listened to, especially in Brussels.

Other countries have been much more willing to recognise that the largest institutions need different treatment and that one should actively try to lighten the compliance burden on smaller banks. For example, in the US, every state has two senators, and they represent their home institutions. The largest bank in the US is the New York-based J.P. Morgan with assets of $2.5 trillion. The largest bank in Utah is Zions Bancorp one 40th the size at $63 billion. Still, Utah and New York have each two senators, giving the relatively tiny Zions Bancorp considerable lobbying power.

Basel III gives the largest banks a leg up in every country, but in the US the smaller banks have a fighting chance. Not so in Europe, where most of the financial rulemaking after the crisis increases both the fixed and variable costs of complying.

A common counterargument is that Europe is full of very small and inefficient banks and it is therefore better increase concentration, have fewer and larger banks. There would be a lot of merit in such an argument if it was the marketplace making it happen. But I don't think is the purpose of financial regulations to bring such an outcome about. It is not even for the financial regulators to consider too much, this is why we have competition authorities.

However, considering that the problem of banks that are systemically important, the SIFIs, is not going away anytime soon, it can't be a good thing if the financial regulations actually make the SIFI problem worse.

Over time, unless Europe finds a way to implement proportionality effectively, this will lead to an increasingly oligopolistic European banking system and an even bigger SIFI problem.